Inside out marketing: Leveraging owned media channels to grow your brand with insight from Nike, Virgin and Rip Curl

This article was originally published by Mi-3

Owned media lies at the heart of modern brand building and growth and is worth millions to those who can harness its power strategically. Those who do it well invest into data, experiences, cross-functional collaboration and customer-led marketing strategy.

During Mi3’s latest roundtable in partnership with Sonder, marketing leaders from across financial services, retail, travel and tourism and hospitality categories were privy to the learnings of former Nike, Myer, Virgin, McDonalds and Rip Curl brand and marketing chief, Michael Scott, plus Sonder founding partner Jonathan Hopkins, on how to make inside-out marketing a reality. Here, we share a few of those valuable insights.

Award-winning, effective marketing campaigns are increasingly based on initiatives powered by owned media channels. Think of the stellar success of Warner Bros and Mattel’s Barbie movie marketing, a program driven through retailers and multiple distribution partner channels rather than heavy investments in paid media. The film became the highest grossing movie of 2023 and 14th highest ever at US$1.45bn. Or take Lego’s growing focus on earned and owned content and channels over traditional, paid advertising campaigns.

The reasons why owned channels are gaining clout are obvious. Brands prioritising paid media to find more reach are spending more but seeing less impact for the dollar. More choice of channels, audiences more in control of the message and less attentive than ever, and increasingly complex, non-linear customer journeys are all to blame here.

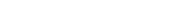

Which is why marketers need to embrace an inside-out marketing model. So what does it take to rethink and leverage owned channels to create lasting revenues and campaign platforms that endure?

To date, Sonder has helped brands unlock $10 billion in unrealised owned media value, with a client list including Telstra, Mecca, David Jones, American Express, 7-Eleven, Officeworks, ANZ and Virgin. The premise is based on flipping what’s been a paid media emphasis for prospecting and awareness, and putting owned assets squarely at the top of the list. For Sonder, owned assets can drive better experiences and more powerful content from the outset.

To detail how, Sonder partnered with Mi3 along with experienced marketing and brand leader, Michael Scott, on a Sydney roundtable to help educate CMOs on the growth opportunity owned media represents to their businesses.

Scott has pioneered the inside-out marketing approach across iconic brands such as Nike, McDonalds, Virgin, Myer and most recently Rip Curl, and is passionate about the impact inside-out marketing can have in businesses. He’s also clued up on how to navigate initial challenges around cross-functional buy-in and building the appetite for change within organisation to realise owned media assets for business value.

Sonder’s inside-out marketing model

Breadth and depth: Recognising owned’s value

For Scott, four types of ‘media’ lie at the marketer’s disposal: Owned, earned, paid and ‘partnered’. But it wasn’t until he started his tenure at Nike in 2006 that the marketing leader began to experience how powerful owned was in this formula. Scott told roundtable attendees the starting point was realising Nike’s Australian business was not firing on all cylinders.

“We were operating and communicating with everyone on everything, trying to be all things to all people. To connect with the tribes in each of those sports with limited budget was putting incredible pressure and stress on the marketing team. So we made quite a radical decision, with executive-level support, to reduce focus on several categories, moving from 15 to three. Just that, in isolation, was a real shift for us,” Scott explained.

Nike landed on women’s training, running and football as its key categories. It then pivoted away from the traditional structure of brand marketing, sales, equipment, footwear, apparel and services and around these categories. The thinking was this would enable the team to put more resources into areas with high audience volumes, thereby creating more opportunity. Yet in doing so, the business was walking away from many millions in guaranteed revenue through sports it typically aligned with. Cue marketing crunch time.

“That was the moment when we and I acknowledged that to do the job through paid media without enough resources wasn’t going to work,” Scott said.

So Nike embraced the philosophy of inside-out marketing. “We needed to leverage it all – paid, earned, owned and partnered. Owned media is everything available in the four walls of your organisation you can tap into to propagate delivery of messaging to your target audiences and customers,” Scott said.

Nike created owned running experiences like The Human Race and She Runs the Night, pre-empted global ecommerce with its football boot ecommerce platform called The Armory and created athlete-driven content to distribute through owned channels.

Scott’s next foray into owned media was at Virgin Australia as GM of brand and marketing, where he was tasked with helping reposition the low-cost player to premium, full-service carrier. Operating on razor thin margins and with just $20m to take on Qantas, the proposition of setting up an owned media business and commercialising owned assets on significantly higher margins became a very attractive one to the executive team.

“With that came a belief in and understanding of the rich assets we had,” Scott said. “These stretched from the discovery stage when you’re searching for a flight, whether that’s our owned digital platforms or off-digital platform; to the airports and arrival in the carpark; into the terminal, lounges, your seat. There are rich, incredible assets to leverage in that journey.”

As Scott makes clear, owned media isn’t just about a commercial retail media proposition, it’s also about delivering more connected customer journeys that achieve desired business outcomes. In his most recent role at Rip Curl as chief customer officer, Scott designed a membership program as a strong, owned asset that paid dividends in terms of first-party data and uplift in customer spend.

“After an extensive review of the business, we recognised customer frequency over the course of 12 months was our single biggest issue. The board agreed a membership program would be the best way to help resolve that. It was a super important piece; a pre-requisite of the membership program was investing in platforms that had the central role of holding data,” Scott said.

“Through that process of the business agreeing on the single biggest problem to solve, we kicked off a terrific team approach. That gave us the momentum to build strong owned assets.”

Lesson 1: Build a plan and secure cross-functional buy-in

Through each of these owned media examples, Scott stressed the criticality of building an upfront plan and securing buy-in from across the organisation. Just like the early days of websites and digital engagement, what became clear through the roundtable discussion is that fragmented functional and structural approaches to channels within the owned ecosystem, such as social media or a brand’s website, have left gaps in how brands leverage these holistically for growth.

“We had good energy around what we were trying to do within the four walls of the organisation and how we’d execute, sequence, and build process around this. I needed to build strategic connections across the business to do so,” Scott said. “What this did is create a very positive construct for us cross-functionally.”

From there, Scott advocated “a lot of broadcasting the journey across to the business to get buy-in and transparency around the process”.

“Perceptions around ownership of owned media isn’t just about you as a marketing person. This requires holistic buy-in from everyone. You need to break down, restructure and realign ownership to enable synchronicity of owned messaging, sequencing and time,” he added.

Ascertain value

It was British scientist, Lord Kelvin, who first said: ‘If you can’t measure it, you can’t improve it’. Sonder founding partner Jonathan Hopkins said one of the reasons why owned media has historically been the ‘forgotten child’ of marketing is that people don’t understand its worth. Which is why it’s important to give owned media assets a monetary value in the same way other media channels are valued.

“To get this started in an organisation there are two fundamental things. One is to do an audit of your owned assets in order to be able to put a value on those – you need that value first. But secondly, knowing who owns each asset, then having a conversation and connecting with them is an incredibly powerful thing and a great place to start,” Scott said.

One question raised during the roundtable discussion was how different owned channels can be ascribed a value when they may have different values in the eyes of each consumer. One consumer might be far more highly engaged with getting a notification in an app, while someone is more engaged with an email, for instance. In response, Hopkins said Sonder evaluates the channel’s media value in the first instance, but then applies 15 -20 other factors, such as brand engagement and sell-through to come to a final value in audits for its clients.

“If a particular owned media format performs better than the market norm, then we’d put a higher value on that,” he explained.

For Scott, there’s also the broader question around how marketing is measuring itself against more business-led outcomes and commercial concerns. “The bottom line is you need to make a budget as a total business, and you need to understand what tools you can add to help deliver value to achieving those business outcomes,” he said.

Scott again brought it back to encouraging teams to have conversations around the business.

“We talked about outcomes, such as performance, bringing dollars in – at Rip Curl, it was about balancing the cost of setting up the membership program with the business outcomes we could deliver. More importantly, if I was saying by attracting 500,000 new members, we gain such incredible insight into what they do, what their journeys are, what values they buy into. That’s all powerful and had huge weight with the executive.”

Such first-party data enabled Scott to build communications, offers, personalisation all coming back to the customer value and currency.

“Amazon has blazed the trail here and set a very high bar for what customers are expecting from retailers,” Hopkins added. “If you understand your data, it’s a very real asset.”

Unified, full-funnel perceptions of value

An Australian retailer that has spent several years building out its owned media proposition explained front-of-house digital screens are now recognised group-wide as the most valuable owned asset. A critical step was adopting a unified definition of owned media from the CEO down.

More recently, the retailer has been on a journey to change perceptions of these assets as trade and promotional mechanisms and realise their power as connective brand tissue. To get there, it has trialled using owned assets for creative that’s more content heavy and encourages a dialogue around cultural moments.

The retailer said its approach was to test a small campaign first to see how it works.

“Because we have value attributed to owned, we did a brand study on just one brand so as to have an option to build brand-first, which was huge for us,” they said. “We have traditionally spent most of our paid money in trade marketing rather than brand. If we can prove out owned as a vehicle, we can have the money to invest in upper funnel brand building. It wasn’t easy, and access to the data was a huge leap – there are barriers to overcome to get that. It’s a process, but we did it.”

While it also takes more work and requires an agility in creative and communications production, the test case has been a catalyst for recognising the power of owned media beyond product-led advertising.

“Now there’s a much bigger conversation around how we take that owned asset from just being trade marketing to ticking off other brand and performance items off our list.”

Owned and personalisation

Another attendee dialling up strategic focus on owned media assets is REA Group. GM of marketing, Sarah Myers, said it had low recognition of just how valuable owned could be at the beginning. But since then, it’s been able to work out it would have had to spend millions annually on paid media if it hadn’t done the work it did building marketing personalisation into consumer engagement.

“Our members are highly engaged consumers and we have built real-time lifecycle marketing campaigns which have increased visitation through owned channels eightfold over the past five years,” she said. “We are continuing to focus on scaling personalisation across the B2B side of the business too.

“The lifecycle is not linear when it comes to audience success. That’s what we started with – we’re not trying to just drive retail.”

Yet as a metrics-driven business, the numbers are interrogated every day, every week and every month. “We are focused on growing and engaging our audience which means many expectations around that and how owned media and broader marketing strategy delivers commercially,” Myers said.

A helpful way of getting going was to break it down into simpler use case that went all the way through the business. By working out what is the right use case for owned media, the aim was also finding a demonstration of financial impact.

“We tried to start fairly small and make sure there was alignment internally, the context and buy-in across technology, product and marketing and making this an equal challenge for all of us to solve was really important from the beginning,” Myers said.

Optimising channels

“If you’re a retail bank with digital screens facing the high streets across Australia, why spend money on out-of-home just down the road?” Hopkins asked. “While we’re not anti-paid media, what we have is an endorsed model building from the inside-out. Building your own channels, understanding what makes them unique, then attracting like-minded customers helps drive acquisition. This is about optimising your channel mix.

“Scale can be achieved with owned assets to achieve your objectives first. That will take us 60 per cent of the way there; the other 40 per cent might be earned, if you’ve created something worth talking about, or more likely paid, depending on the brand.”

To learn more about this marketing approach, please view the ‘inside-out marketing’ explainer video or contact Sonder.

Engage With Sonder

We believe your fortune lies within. Look within to reframe your perspective on how to find growth.

Contact us to unlock new revenue today