Money on the table: 50 top marketers on where owned media goes next

This article was originally published by Mi-3

Blue chip brands are moving to monetise owned media with fresh data from 50 senior marketers across 40 companies signalling a significant shift from planning to commercial action over the next 12 months. But the data also highlights gaps and strategic oversights that suggest huge value is being left on the table.

What you need to know:

- Owned media experts Sonder and research firm Infuse have surveyed 50 senior marketing leaders across 40 companies in 22 different countries on how they are currently harnessing owned media – and where they plan to change that approach.

- The data shows marketers recognise owned media as a powerful, untapped asset to create new revenue streams, and close to 27 per cent intend to increase media value representation in partner deals in the future.

- 36 per cent of companies are currently providing owned media value to partners at no cost or not leveraging it at all.

- 54 per cent of marketers work with their brand partners frequently – either “all the time” or more than five times per month.

- Two-thirds of marketers will increase their owned media leverage in the next 12 months.

- 60 per cent of respondents do not have an owned media rate card, limiting their ability to monetise their assets effectively.

- Less than a third of respondents use audience targeting, ad-serving, campaign optimisation, and monetisation software platforms.

- Over half of the respondents leverage their first-party data with partner brands through customer targeting.

- Marketers are missing the tools to capture the opportunity.

Here are some of the core findings:

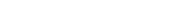

Current and future owned media leverage plans

With 37 per cent of senior marketers reporting that they use owned media primarily for brand building and internal marketing, many overlook its commercial potential.

36 per cent of companies are providing owned media value to partners at no cost or not leveraging it all. This points to a significant value gap between owned media’s current use and its strategic potential as a growth engine for brands.

Marketers aim to increase media value representation in partner deals – from 15 per cent to 27 per cent in the next two years. However, there is still more opportunity: 13 per cent do not have strategic intent to ‘sell to partners for cash’ or ‘do not leverage’ over the next few years. This represents a lot of money being left on the table.

The true power of owned media lies not just in brand support, but in unlocking its revenue potential. Marketers that shift from supporting brand awareness to leveraging owned media as a revenue-driving channel can deliver new growth and income opportunities.

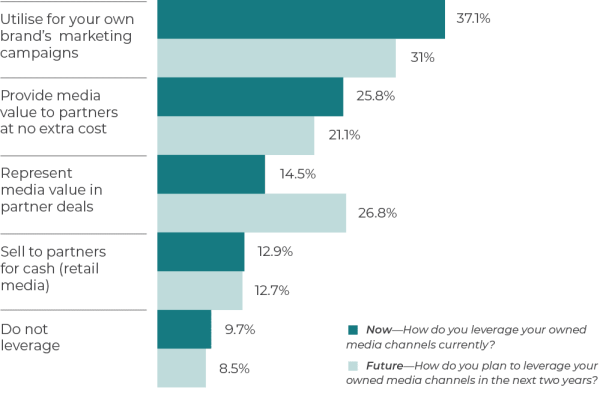

Majority of marketers believe their organisation’s owned media leverage will increase in the next 12 months:

Q: Do you believe your organisation’s owned media leverage will increase in the next 12 months?

Two thirds of marketers will increase their owned media leverage in the next 12 months. The anticipated growth in using owned media reflects a strategic opportunity. As marketers develop their use of owned media, they find more sophisticated ways to structure brand partnerships and more opportunities. In other words, owned media utilisation creates its own flywheel effect as growth generates growth.

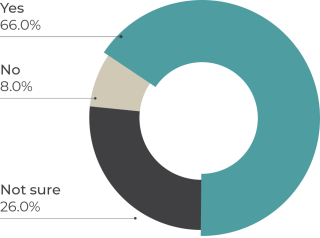

Majority do not have an owned media rate card:

Q: Do you have an owned media rate card?

Many marketers are operating with one hand tied behind their back. 60 per cent of respondents do not operate with a rate card. An owned media rate card is the key to unlocking and operationalising owned media leverage and revenue. Marketers need to have an independent, validated approach to measurement of all owned media assets before they communicate value with partners.

Partner brand marketing support is frequent but given away:

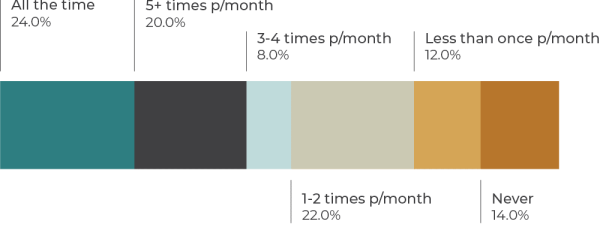

Q: How often do you support brand partners in your owned media?

54 per cent of marketers work with their brand partners frequently—either “all the time” or more than five times per month, indicating there is high demand from the partners but the owned media networks haven’t yet caught up with that demand.

First party data is given away to partner brands

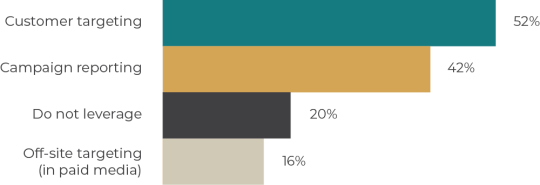

Q: How do you currently leverage your first party data with partner brands? *The sum of response percentages exceeds 100% due to some respondents providing multiple answers.

Over half of the respondents leverage their first party data with partner brands through customer targeting. Customer data is a high value asset as it offers something brand partners cannot get elsewhere:

- Targeting based on purchase behaviour.

- Zero wastage.

- Customer acquisition.

Given only 13 per cent of companies researched are selling media for cash, it is likely that the majority are giving away their customer data, which is their most valued asset. Anonymised customer data is the crown jewel in owned media leverage and its strategic use is pivotal in unlocking partner revenues.

Software solutions are in the early stage of adoption

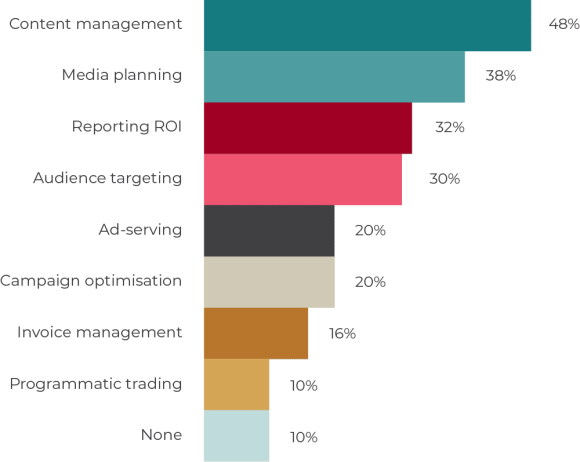

Q: What type of software solutions do you have set up to manage and measure owned media? *The sum of response percentages exceeds 100% due to some respondents providing multiple answers.

90 per cent of the marketers surveyed have some solutions for managing and planning owned media. Chief among them are content management (48 per cent) and media planning (38 per cent), which help companies create targeted, consistent, and data-driven campaigns that maximize engagement with their customer base.

Content management solutions provide a centralized platform to create, store, and manage content across different channels, enabling businesses to streamline their content creation process and ensure consistency in tone and branding. Organisations can also use these solutions to measure the effectiveness of their content and make data-driven decisions for future content creation and distribution.

Less than a third of respondents use audience targeting, ad-serving, campaign optimisation and monetisation software platforms. This clearly demonstrates that the market is still in its infancy when it comes to commercialisation of their owned media potential.

Market Mix Modeling is better established

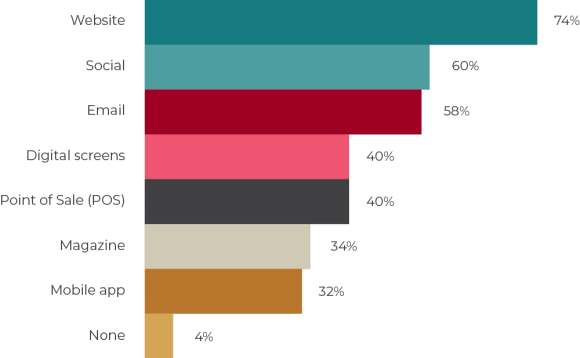

Q: In which channels do you have Marketing Mix Modelling set up to attribute the value of owned media in your marketing? *The sum of response percentages exceeds 100% due to some respondents providing multiple answers.

Market Mix Modeling (MMM) is used to evaluate the effectiveness of a company’s marketing strategies and to optimize the allocation of its marketing budget. According to survey results, it is most commonly used for website, email, and social channels, which are critical to driving engagement and conversions.

On the journey to unlock the hidden value of their owned media, increasingly more companies are likely to set up MMM for other owned media channels as well. We would expect digital screen measurement to increase with technologies like eye-tracking beginning to be deployed.

Time to act

Owned media leverage represents one of the most profitable, scalable, and sustainable marketing opportunities today, but many businesses are yet to capitalise on it.

With brands increasingly looking to monetise their owned assets, build mutually-beneficial partnerships, and reduce reliance on paid media channels, the market is evolving fast. Companies that move soon will gain a significant competitive edge.

Leaving money on the table? Download Sonder’s 2025 Owned Media Global Market Report to start working on the solution.

Engage With Sonder

We believe your fortune lies within. Look within to reframe your perspective on how to find growth.

Contact us to unlock new revenue today