Businesses continue to highly value the attention they buy through paid media, yet at the same time, many continue to disregard and under-value opportunities to connect with customers using their owned media.

Every dollar invested in paid media is scrutinised by CMOs for ROI, reach and sales increases - in short any quantifiable metrics available - to ensure it is money well spent and can be justified to the CEO, Board and shareholders.

Yet, at the same time new opportunities to reach customers through owned media, which sometimes requires little to no additional investment, are still being ignored by marketers.

When we last spoke with CMO Magazine in November 2016, we were being conservative when we said Australian businesses could unlock $49 million in revenue annually by better utilising their owned media.

There is even more potential, if there is the will of the business and the drive of the CMO to steer towards the opportunities presented by owned media.

Get your share

Over the past 20 years we have witnessed a seismic shift in the media landscape, from TV, print, radio, digital and outdoor to a retailer (Amazon), a social network (Facebook) and a search engine (Google) being the largest media owners in the world.

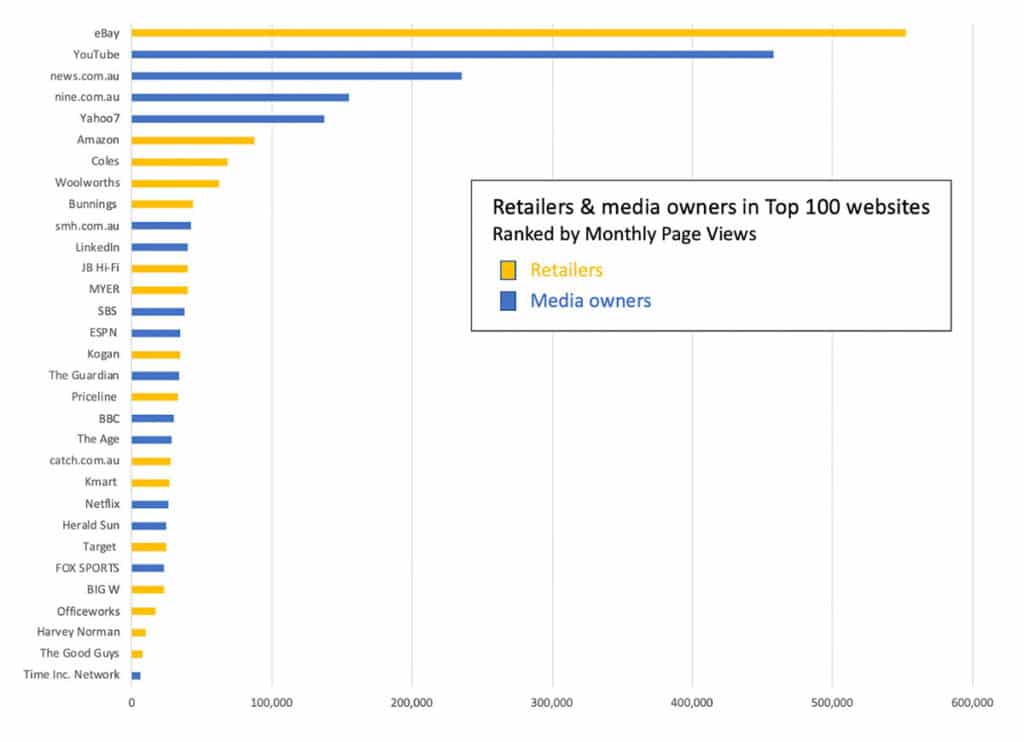

Businesses are the new media owners as evidenced by the fact there are more retailers than traditional owners listed as having one of Australia’s top 100 websites.

Source: Nielsen Monthly Page Views

Why is owned media still under-valued?

In our experience, owned media channels for the most part continue to be grossly undervalued by marketers in three key ways:

- As an under-leveraged ecosystem to drive customer acquisition, retention and advocacy

- As a way to harness data for the data-owner and their suppliers/partners

- A revenue generator when serving the three constituents of customers, suppliers and their business

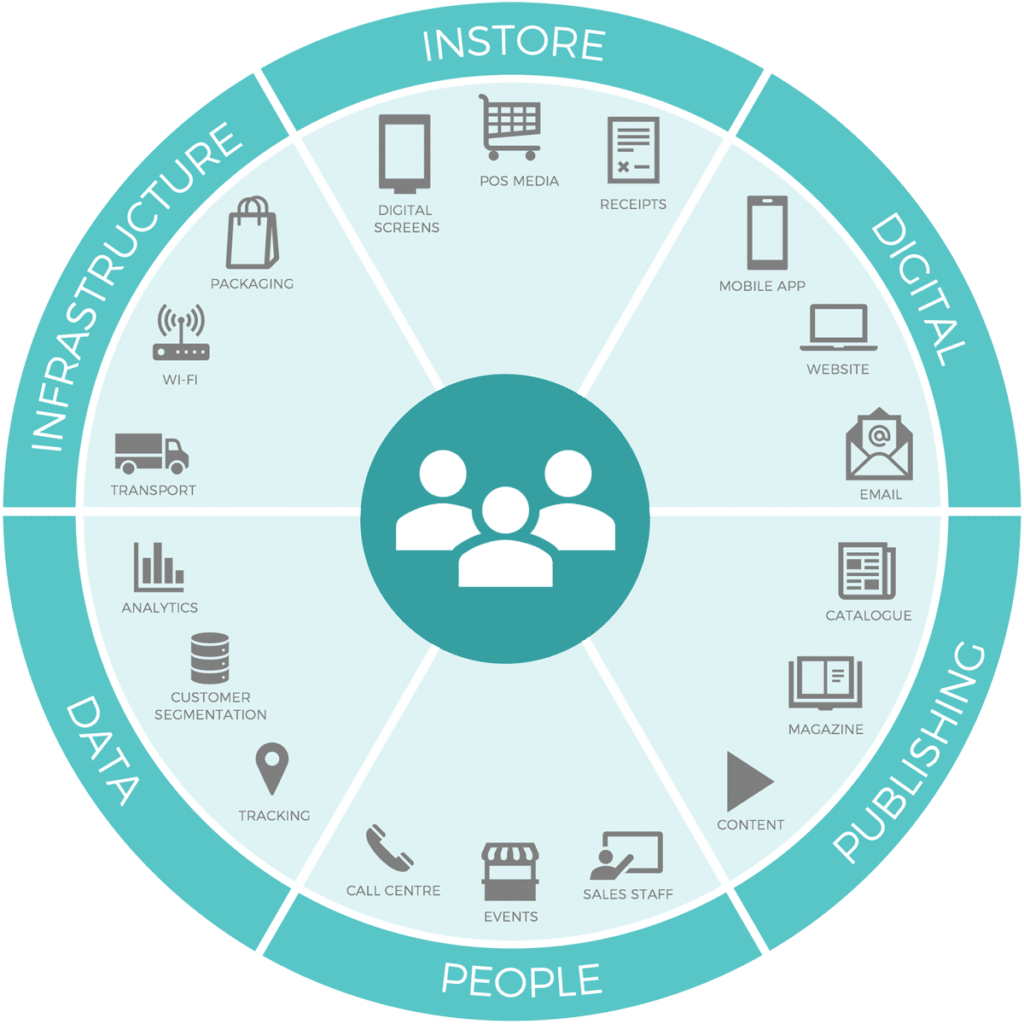

Look at this wheel and think about the media assets in your business you could leverage more:

Outside the obvious channels like email, store networks, websites and apps, even outliers like uniforms, call-centre endorsements and trucks have tremendous value in driving brand values, retaining customers and generating advocacy. These channels are where trust is formed and in this connection economy, trust is the new currency of marketing.

Leveraging data

The quality of data available to CMOs today presents new opportunities which allow partners to sensitively communicate valuable offers and messages with their customers. We have seen this in the retail and grocery space for years with Woolworths and Quantium, Coles Flybuys, Amazon and Walmart.

Corporations now have customer data which traditional media owners could only dream of. This data allows them to create targeting segments specifically for suppliers based on attributes like:

- PROFILE - This group matches your demographic profile

- CATEGORY - This group is active in your category

- BRAND - This group has purchased your brand

- ACQUISITION - This group is active in the category, but not your brand (or lapsed users of brand / future intenders)

- MEDIA - This group has previously responded to this type of message in this media channel

- CUSTOM - This group exhibits a certain behaviour requested by the partner (based on a combination of the above factors)

This means businesses can offer suppliers zero wastage, a concept which is completely foreign to TV, outdoor and many spray’n’pray digital media owners. And it’s all in a trusted, brand-safe environment, which is as close to the point of purchase as possible. Quite a compelling offer to any advertiser!

A much-needed revenue generator

Faced with increased competition, technological and societal changes and shrinking margins, most businesses are seeking new revenue streams. Advertising revenue is the highest growth revenue stream for retailers at the moment.

We currently value Australia’s owned media at $96 billion and retailers, telecommunications, financial institutions and airlines all have media asset values over $150 million.

The fastest growing division in Amazon is not its e-commerce sales, or its services like Prime, but their media sales division. According to research firm, EMarketer Inc, revenues have more than doubled from $1.8 billion in 2017 to $4.6 billion in 2018.

And if you think that’s impressive, it’s about really take off with the reorganisation of Amazon’s disparate media divisions into one central unit. Wall Street firm, S.G. Coven, estimates that Amazon could generate ad sales revenue of $24.8 billion in five years’ time

With so many opportunities to leverage owned media assets available and so much possible revenue on the table, the question has to be asked: why are CMOs not capitalising on the vast media networks they already own?

This article originally appeared in CMO Magazine and can be viewed here: